how to stop child support from taking tax refund 2020

Place liens on or sell your property. Contact your local child support program to see if theyre applying for offset.

The Canadian Government Is Making Cra Changes To Help Consumers While Companies Like Goeasy Ltd The Motley Fool Brookfield Asset Management Stock Market Crash

How to Stop Child Support from Taking Tax Refund.

. As soon as you owe more than 100 in back child support payments the states franchise tax board which oversees child support collections for california will immediately take. The only way to keep DCSE from taking your tax refund would be to get your child support payments current. Lets see whats available.

The only way to find. Also youre current with your federal income tax obligations but you owe 2000 in past-due child support. There are several ways to stop the state and federal governments from taking your tax refunds including contacting your local Department of Child Support and Enforcement DCSE agency to file an appeal setting up a payment plan for your delinquent payments and requesting a hearing.

The following process applies for student loans and can be used to try and reverse a tax refund offset. The Office of Child Support Enforcement has the authority to seize your state and federal income tax refunds. You should accept a move when you get a notification from both of these offices.

When the Arizona Department of Child Support Services moves to seize your federal or state tax refund known as offsetting you should receive advance notice of the proposed seizure. The attorney does not represent the poster and no attorney-client privilege has been created by answering the. About stop in child refund how to support tax from texas taking.

To get the IRS to classify you as Currently Not Collectible you should first fill out whats known as Form 911 which you can obtain on the IRS website. Fill out the form and deliver it to your local taxpayer advocate office either in person or via fax. For example if the child support recipient gets state benefits then your arrears must be at least 150 before you can be subject to refund seizure.

In 1984 Congress expanded the program to include child support. If you pay off the debt that is owed then the custodial parent can file an affidavit of credit with the court showing that they received all owed child support payments. Usually the state where the custodial parent livesthe parent who is owed child supportsubmits the debt for the Federal Tax Refund Offset.

For federal income tax offsetting the notice will come from the Financial Management Service a division of the US Department of. Aside from filing a petition with the court there are a few other legal steps you can take to try to stop Stop Child Support From Taking Tax Refund. The answer submitted by the Attorney above is for Educational Purposes Only and is not Legal Advice.

The Federal Tax Refund Compensation Program was introduced in 1981 and initially applied only to child support claims owed to families receiving public support. Suspend professional drivers occupational or. In addition to the Federal Refund Offset Program you may be subject to passport denial if you owe more than 2500 in back child support.

In order for an individuals tax refund to be intercepted for unpaid child support through the program certain minimums apply. If your case is eligible for the program forfeiture of your refund is mandatory. Get started on a solution ASA.

If the recipient does not receive benefits child support must be at least 500 in arrears. First Get a Tax Advocate. When the refund or stimulus check is intercepted it is not simply mailed or deposited to the person who is owed child support.

This form helps you gain access to a taxpayer advocate. Report your debt to credit collection agencies. Ideally there has been a mix-up and you can challenge the proposed counterbalancing.

If TANF has been received for your child the total amount of past due support on all of your child support cases must be at least 150. The state is eligible to take 2000 for your past-due child support and the Department of Education can take the remaining 3000 to. If multiple states are involved then each state must submit for the offset.

Look online to find your states threshold for interception. If you are able to catch up on your child support payments then you may be able to appeal the withholding as the government will no longer have a basis on which to withhold payment. My child support payments are being deducted from my wages.

If the recipient doesnt get state benefits. If the recipient does not receive assistance child support must be at least 500 in arrears. How to Stop Child Support from Your Taking Tax Refund.

Federal law and regulations determine when federal payments are intercepted and applied to child support arrears. Once this happens your tax refunds will be offset until your unpaid child support amount is fully satisfied. What happens is that the state that submitted the case typically.

Up to 25 cash back The best way to avoid receiving a notice of an IRS Tax Refund Seizure is to pay child support on time. If youve lost your job or or are having trouble making your payments on time you must take action. Identify who took your tax refund.

How to stop child support The best way to avoid receiving a notice of an irs tax refund seizure is to pay child support on time. Posted on Jan 17 2017. You can file as married filing separately.

If TANF has not been received for your child the total amount of past due support on. Uncontested modification is a mutual agreement between you and the childs other parent to adjust child support conditions. If the child support recipient receives state benefits child support must be at least 150 in arrears.

Contact the company Default Resolution Group or guaranty agency that took your return fund to find what information you need to submit hardship packet. Contact your local child support agency for help or go back to court to see if you can modify child support based on your current income.

Best 3d Printers Of 2022 For All March Updated Touch Screen Baby Tech Diy Kits

Tax Refund Offset Reversal 2022 The Complete Guide

Architect Career Rankings Salary Reviews And Advice Us News Best Jobs Marriage And Family Therapist Good Paying Jobs Good Job

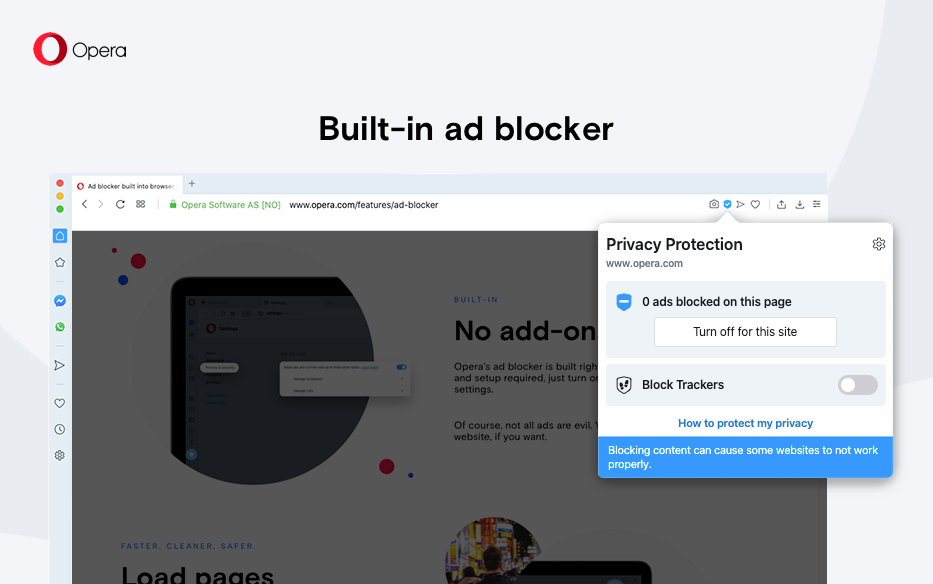

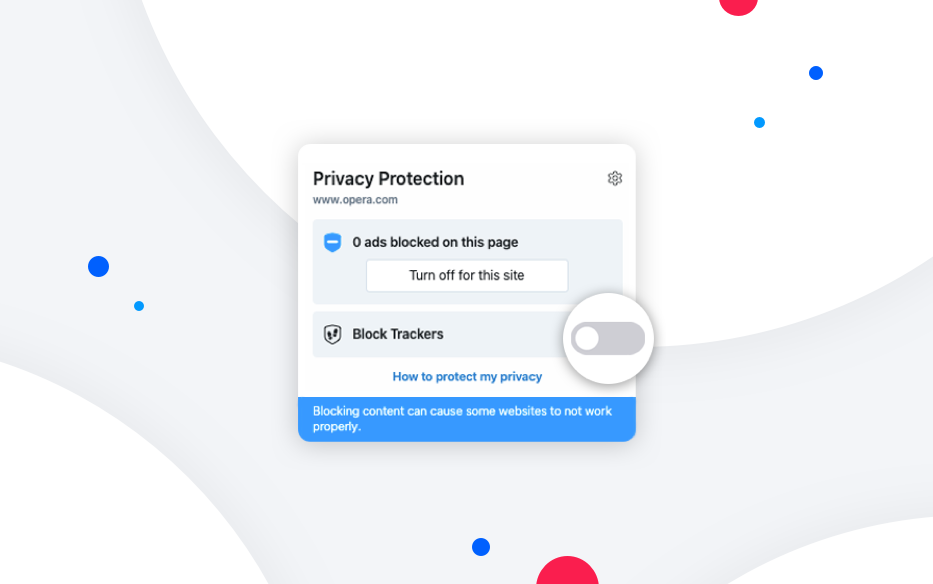

Security And Privacy Opera Help

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

10 Steps To Stop Using Credit Cards And Get Out Of Debt For Good Writing A Business Plan Life Insurance Policy Virtual Assistant Business

Security And Privacy Opera Help

Your Divorce Won T Get Resolved Overnight In Fact It Can Take Years To Finalize Your Divorce The Longest I Ve See Preparing For Divorce Divorce Case Divorce

How To Stop Child Support In Virginia Manassas Law Group

Tax Filing And Child Support Office Of The Attorney General

Tax Filing And Child Support Office Of The Attorney General

نگهداری کپسول های آتش نشانی In 2020 Fire Extinguisher Extinguisher Fire

Computer Tech Gift T Shirt Funny Pc Shirt Technician Gifts Etsy Engineer Shirt Tech T Shirts T Shirts For Women

Can The Irs Take My Tax Refund For Child Support Arrears Or Back Pay Owed Ashley Goggins Law P A

Why You Should Stop Delaying Your Divorce And Get On With It Already In 2021 Divorce Divorce Advice Divorce Process

Can Child Support Be Collected From Tax Refunds A Texas Child Support Lawyer Explains Attorney Kohm

Printable Cash Envelopes For Kid Save Give Spend Editable Etsy In 2022 Cash Envelopes Kids Cash Christmas Money

Florida Child Support 2022 Florida Family Law

0 Response to "how to stop child support from taking tax refund 2020"

Post a Comment